Allen M 2014 Nov 10 Data Security Governance Continue to Be Business Fails

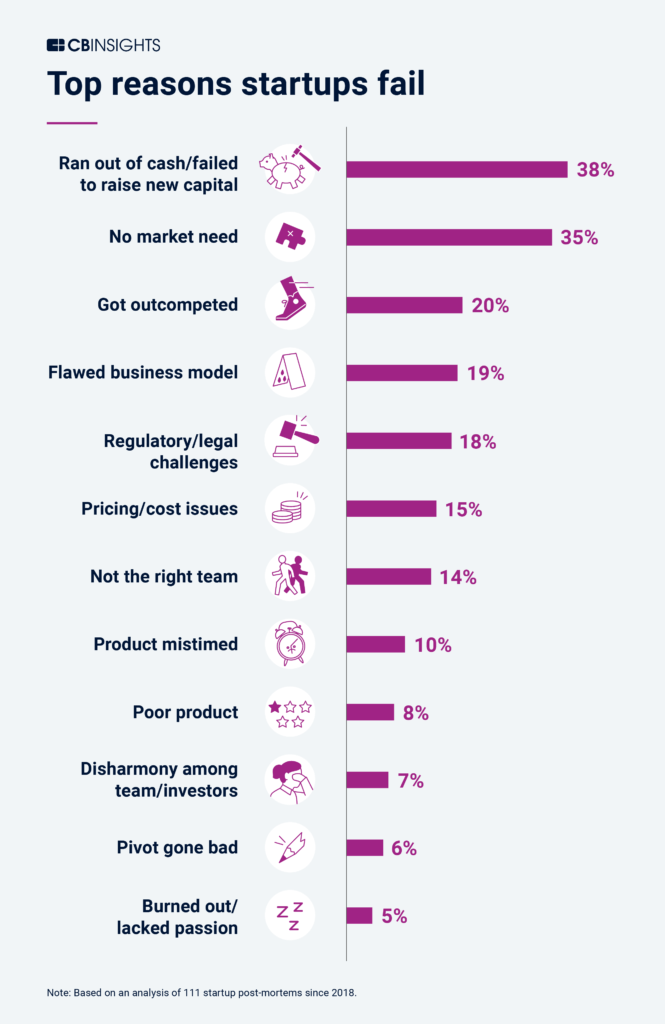

From lack of product-market fit to disharmony on the team, we break down the top 12 reasons for startup failure by analyzing 110+ startup failure post-mortems.

After we compiled our list of startup failure post-mortems , one of the most frequent requests we got was to use these posts to figure out the main reasons why startups failed.

Startups, corporations, investors, economic development folks, academics, and journalists all wanted some insight into the question:

"Why do startups fail?"

So we gave those post-mortems the CB Insights data treatment to see if we could answer this question.

After reading through 111 post-mortems since 2018, we've learned there is rarely one reason for a single startup's failure. However, we did begin to see a pattern to these stories.

And so after sifting through the post-mortems, we identified the top 12 reasons startups fail.

Since many startups offered multiple reasons for their failure, you'll see that the chart highlighting the top reasons doesn't add up to 100% (it far exceeds it).

Following the chart is an explanation of each reason and relevant examples from the post-mortems.

the top 12 reasons startups fail

From lack of product-market fit to disharmony on the team, we break down the top 12 reasons for startup failure by analyzing 110+ startup failure post-mortems.

There is certainly no survivorship bias here. But many very relevant lessons for anyone in the entrepreneurial ecosystem.

It's worth noting that this type of data-driven analysis would not be possible without a number of founders being courageous enough to share stories of their startup's demise with the world. So a big thank you to them.

12. Burned out/lacked passion

Work-life balance is not something that startup founders often get, so the risk of burning out is high. Burnout was given as a reason for failure 5% of the time. The ability to cut your losses where necessary and redirect your efforts when you see a dead end — or lack passion for a domain — was deemed important to succeeding and avoiding burnout, as was having a solid, diverse, and driven team so that responsibilities can be shared.

What can make conversations about burnout difficult, especially in Silicon Valley, is the widespread belief that building a successful company will always involve some degree of possibly hazardous overwork. As former Uber board member and CEO of Thrive Global Arianna Huffington puts it:

"The prevalent view of startup founders in Silicon Valley is a delusion that in order to succeed, in order to build a high-growth company, you need to burn out."

Amid the pandemic, burnout became even more prevalent among tech workers: 68% of tech employees said they felt more burned out working from home, according to a survey by Blind.

Various founders have spoken up about how damaging burnout can be. Former Zenefits CEO Parker Conrad said,

"I think people are unprepared for how hard and awful it is going to be to start a company. I certainly was."

At DaWanda, stagnation in both growth and team interest led to the company's eventual closure. Founder and CEO Claudia Helming shared this message on the company's website:

"In the last quarter of 2017 we reached profitability and have since been working to cover our costs. At the same time, we had to admit that our growth is stagnating and that we can hardly manage by our own efforts to grow the number of sales on our platform to the desired extent – even our restructuring last year could not change this … Additionally, we haven't managed to implement enough innovative new ideas over the past few years.

DaWanda is not insolvent. However, we have realised that the risk of no longer being able to keep up is simply too big."

Doughbies , which raised $670,000 for an on-demand cookie delivery service in 2013, also cited a lack of passion from its founders and team as one of the reasons for its failure. The company appeared to be doing well, with 36% gross margins and 12% net profit at the time it shut down . The problem, as CEO Daniel Conway put it, was that there wasn't massive growth or enough interest in running the business:

"Ultimately we shut down because our team is ready to move on to something new."

11. Pivot gone bad

Pivots like Burbn to Instagram or ThePoint to Groupon can go extraordinarily well. Or they can start you down the wrong road.

As The Verge reported on Inboard Technology's failed pivot:

"The startup was one of the highest-profile competitors to top electric skateboard company Boosted, and last year announced plans to enter the electric scooter market — a push that seems to have doomed Inboard.

Founder (and now-former CEO) Ryan Evans told The Verge his team had locked down 'a very large order' from 'one of the largest European scooter operators,' which explains why the company quickly pivoted away from trying to sell its first e-scooter directly to consumers earlier this year. But Evans said the development timeline for Inboard's e-scooter 'outstretched' its financial runway."

After investors refused to inject more funds, the company was forced to shut down.

For Frances Dewing, the founder of Rubica, a last-ditch attempt to save her cybersecurity startup from failure amid Covid-19 led her to pivot from focusing on consumers and small businesses to larger companies.

In the end, the new direction didn't ring true with investors:

"We were all really surprised given how relevant and needed this is right now," Dewing said. "Investors didn't agree with that or see it in the same way."

10. Disharmony among team/investors

Discord with a co-founder was a fatal issue for startup post-mortem companies. But acrimony isn't limited to the founding team, and when things go bad with a board or investor, it can get ugly pretty quickly, as evidenced in the case of Hubba.

Douglas Soltys writes for BetaKit:

"Considered for most of the decade one of Toronto's hottest startups, Hubba hit choppy waves in 2018, as the company lost its chief technology officer and chief marketing officer in an three-month span, in addition to two rounds of layoffs which saw headcount reduced by almost half.

It is unclear to what extent the COVID-19 pandemic had hampered Hubba's growth and customer base. However, one source BetaKit spoke with claimed a months-long battle between [Hubba CEO and founder Ben] Zifkin and Hubba's board of directors regarding the ongoing viability of the company."

At Pellion Technologies , the end came more quietly, as its major backer Khosla Ventures lost faith in the company's ability to execute :

"According to former employees, all of whom requested anonymity, Khosla Ventures lost confidence that Pellion could make enough money serving a niche market. The lithium-metal technology worked for products like drones, but the big money in the battery world is in the automotive sector. Investors weren't willing to sink the money needed to develop the battery for electric vehicles."

In March 2019, Khosla decided the company would be shut down and removed Pellion's name from its online firm portfolio.

9. Poor product

Sometimes, it all comes down to the product — and a flawed one was enough to sink companies in 8% of cases.

According to a Forbes investigation into finance and accounting platform ScaleFactor,

"ScaleFactor used aggressive sales tactics and prioritized chasing capital instead of building software that ultimately fell far short of what it promised, according to interviews with 15 former employees and executives. When customers fled, executives tried to obscure the real damage."

Bad things also happen when you ignore what users want and need, whether consciously or accidentally.

Here's what Shoes of Prey wrote about its vision to enable consumers to personalize their own shoes:

"We learnt the hard way that mass market customers don't want to create, they want to be inspired and shown what to wear. They want to see the latest trends, what celebrities and Instagram influencers are wearing and they want to wear exactly that — both the style and the brand."

the top 12 reasons startups fail

From lack of product-market fit to disharmony on the team, we break down the top 12 reasons for startup failure by analyzing 110+ startup failure post-mortems.

8. Product mistimed

If you release your product too early, users may write it off as not good enough, and getting them back may be difficult if their first impression of you is negative. And if you release your product too late, you may have missed your window of opportunity in the market.

As Stefan Seltz-Axmacher, CEO of autonomous trucking tech startup Starsky Robotics said,

"Timing, more than anything else, is what I think is to blame for our unfortunate fate. Our approach, I still believe, was the right one but the space was too overwhelmed with the unmet promise of AI to focus on a practical solution. As those breakthroughs failed to appear, the downpour of investor interest became a drizzle."

VR platform Vreal intended to build a virtual reality space for video game streamers to hang out with their viewers and raised almost $12M in its 2018 Series A. However, the available hardware and bandwidth capabilities didn't evolve as fast as the company had expected, and though it delivered on its promise, Vreal struggled to attract any significant usage:

"Unfortunately, the VR market never developed as quickly as we all had hoped, and we were definitely ahead of our time. As a result, Vreal is shutting down operations and our wonderful team members are moving on to other opportunities."

For some companies on our list, an unforeseen factor like the Covid-19 pandemic contributed to product untimeliness. AI-powered vending machine startup Stockwell AI shut down in July 2020 as consumers stayed at home and avoided surface contact. The company's CEO Paul McDonald wrote in an email to TechCrunch,

"Regretfully, the current landscape has created a situation in which we can no longer continue our operations and will be winding down the company on July 1st. We are deeply grateful to our talented team, incredible partners and investors, and our amazing shoppers that made this possible. While this wasn't the way we wanted to end this journey, we are confident that our vision of bringing the store to where people live, work and play will live on through other amazing companies, products and services."

7. Not the right team

A diverse team with different skill sets was often cited as being critical to the success of a company. Failure post-mortems often lamented that "I wish we had a CTO from the start" or wished that the startup had "a founder that loved the business aspect of things."

At Fieldbook, which shut down after failing to build a sustainable business model for its database product, co-founder Jason Crawford wrote in his post-mortem blog post that the company's inability to make key hires was one of the reasons for its downfall:

"I was blindsided by the difficulty of hiring. Hiring was something I'd done successfully for years, including in the early days of Fieldbook and in a previous startup. But at a time when every engineer wanted to work on AI, self-driving cars or cryptocurrencies, a SaaS startup with modest, sporadic growth wasn't very attractive. I knew that investors would need to see strong, consistent growth before our Series A, but I didn't expect that engineers would need to see it to even join before Series A."

Lack of experience, combined with mismanagement, was one of the factors behind the downfall of Katerra, the high-flying construction startup which raised nearly $1.5B in funding. As The Information summarizes,

"The SoftBank-backed startup said it could slash the cost of building and renovating apartments, luring big-name investors. But the company, run by a tech veteran with no previous construction experience, ignored escalating problems and at one point tried to burnish revenue information shown to its board and financial backers."

For Stratolaunch, the passing of its founder meant the company wasn't able to continue on in the same way, as Failory reported:

"Despite everything looking great on paper and the best of minds working together on this project, nothing could have predicted Paul Allen's passing away in October of 2018, which would soon spell out the same fate for Stratolaunch. It became clear that Stratolaunch had been powered only by the vision of its founder, which wasn't necessarily shared by those left in power after him."

6. Pricing/cost issues

Pricing is a dark art when it comes to startup success, and startup post-mortems highlight the difficulty in pricing a product high enough to eventually cover costs but low enough to bring in customers.

Hey Tiger struggled to find the right balance in its effort to produce high-quality chocolate and address inequities in the cocoa industry, writing,

"But like any start up, there comes a time when you need to take a hard look at the company's long term viability. Although we designed a business that customers absolutely love, it proved hard to scale into the profitability it needed to be a sustainable social enterprise. As the scale of our chocolate production grew, so did the tensions between the very things that made Hey Tiger special. Ultimately while succeeding in one goal, we couldn't make the other."

The 2019 shutdown of genetic testing and scientific wellness startup Arivale came as a surprise to many partners and customers, but the reason behind the company's failure was simple: the price of running the company was too high compared to the revenues it brought in:

"Our decision to terminate the program today comes despite the fact that customer engagement and satisfaction with the program is high and the clinical health markers of many customers have improved significantly. Our decision to cease operations is attributable to the simple fact that the cost of providing the program exceeds what our customers can pay for it. We believe the costs of collecting the genetic, blood and microbiome assays that form the foundation of the program will eventually decline to a point where the program can be delivered to consumers cost-effectively. Regrettably, we are unable to continue to operate at a loss until that time arrives…"

5. Regulatory/legal challenges

Sometimes a startup can evolve from a simple idea and enter a world of legal complexities that can ultimately shut it down.

Widely regarded as one of Kickstarter's greatest failures, Coolest Cooler finally ceased operations in December 2019 after floundering for 5 years (and failing to deliver its coolers to more than 20,000 people). In a project update, the team blamed the trade war:

"As you may know, late last year the U.S. government imposed 10% tariffs on many products imported from China. … However, as of early summer, the "trade war" continued, and the tariff was increased to 25% which affected our entire Coolest product line."

Mobile savings app Beam met its end quickly after falling afoul of the Federal Trade Commission. FTC Acting Director of Consumer Protection Daniel Kaufman stated at the time of its shut down of the company:

"The message here is simple for mobile banking apps and similar services: Don't lie about your customers' ability to get their money when they need it."

Smart luggage manufacturer Bluesmart also fell victim to legal challenges. The company shut down in 2018 after most major US airlines enacted a policy requiring all airline travelers to remove lithium-ion batteries from their checked luggage :

"We have bittersweet news to share. The changes in policies announced by several major airlines at the end of last year—the banning of smart luggage with non-removable batteries—put our company in an irreversibly difficult financial and business situation. After exploring all the possible options for pivoting and moving forward, the company was finally forced to wind down its operations and explore disposition options, unable to continue operating as an independent entity."

4. Flawed business model

Most failed founders agree that a business model is important — staying wedded to a single channel or failing to find ways to make money at scale left investors hesitant and founders unable to capitalize on any traction gained.

As Lumina Networks, a provider of open-source software for telecom networks, wrote,

"Essentially, revenue continued to flow to proprietary vendors. The switch to open source did not take place at a pace anywhere close to the speed that would enable us to operate and grow our business, despite commitments from many to the contrary. We have also found that Covid-19 has actually redirected funds away from automation projects and into building-out raw infrastructure, further delaying adoption."

"Selling Lumina to a proprietary vendor who is naturally antithetical to our mission proved an impossible task and for this reason we must now close our business," it concluded.

At Aria Insights , the concept of outfitting drones with sensors to collect data from extreme environments seemed promising. But while the company got off the ground and found a few high-profile investors — including Bessemer Venture Partners — it ultimately couldn't find a compelling use for that data, and, therefore, couldn't adequately monetize its business model:

"CyPhy Works rebranded as Aria Insights in January 2019 to focus more on using artificial intelligence and machine learning to help analyze data collected by drones. 'A number of our partners were collecting and housing massive amounts of information with our drones, but there was no service in the industry to quickly and efficiently turn that data into actionable insights,' Lance Vanden Brook, former CyPhy and current Aria CEO said at the time of the rebranding."

Various music startup post-mortems also pointed to the difficulty of finding a viable business model in the industry as a reason for startup failure.

UK-based blockchain music startup JAAK pointed to several reasons for its undoing, including its scaling challenges, in a series of Tweets on the company's corporate account:

"6 years is a long time in startups, especially pre-revenue ones, and, ultimately, we failed to secure the funding required to get to market. Markets change and we didn't change quickly enough.

I have a Notion full of painful lessons about why we failed but I'll save those for another day.

tl;dr: users > partners, no premature scaling."

the top 12 reasons startups fail

From lack of product-market fit to disharmony on the team, we break down the top 12 reasons for startup failure by analyzing 110+ startup failure post-mortems.

3. Got outcompeted

Despite the platitudes that startups shouldn't pay attention to the competition, the reality is that once an idea gets hot or gets market validation, others may try to capitalize on the opportunity. And while obsessing over the competition is not healthy, ignoring it was also a recipe for failure in 20% of the startup failures.

Silas Adekunle of Reach Robotics talked about shutting down after being unable to make it in the hypercompetitive consumer hardware industry in his post-mortem message, stating:

"The consumer robotics sector is an inherently challenging space – especially for a start-up. Over the past six years, we have taken on this challenge with consistent passion and ingenuity. From the first trials of development to accelerators and funding rounds, we have fought to bring MekaMon to life and into the hands of the next generation of tech pioneers. Unfortunately, for Reach Robotics, in its current form at least, today marks the end of that journey."

Co-founder John Rees also weighed in:

"I'm still taking stock of it all but the short version is that it is true what they say – that 'hardware is hard' and consumer hardware is even harder due to the reliance on the Christmas sales period."

Children's apparel delivery service Mac & Mia found itself in a tough spot, facing competition from highly successful companies like Stitch Fix, and shut down only a year after its 2018 launch:

"Mac & Mia faced a host of competitors in the children's delivery box space, including the aforementioned Stitch Fix, which launched its kids clothing service in 2018. Stitch Fix went public in 2017 and has a market cap around $2.7 billion. At least 20 other upstarts have launched similar delivery services for children's clothes."

2. No market need

Tackling problems that are interesting to solve rather than those that serve a market need was cited as the No. 2 reason for failure, noted in 35% of cases.

Mobile-focused streaming service Quibi, which shut down in October 2020 just 6 months after launching and raising a mammoth $1.8B, found itself in this position. As reported in the Wall Street Journal, founder Jeffrey Katzenberg and chief executive Meg Whitman said in a letter to employees at the time of the shutdown:

"…[T]here were 'one or two reasons' for Quibi's failure: The idea behind Quibi either 'wasn't strong enough to justify a stand-alone streaming service' or the service's launch in the middle of a pandemic was particularly ill-timed. 'Unfortunately, we will never know, but we suspect it's been a combination of the two.'"

CEO Justin Kan of Atrium was direct about the difficulty of disrupting law firms, telling TechCrunch in an interview,

"If you look at our original business model with the verticalized law firm, a lot of these companies that have this kind of full stack model are not going to survive," Kan explained. "A lot of these companies, Atrium included, did not figure out how to make a dent in operational efficiency."

For a company like wedding dress retailer Brideside, Covid-19 obviated the need for its offerings:

"With two-thirds of weddings cancelled in 2020 and an uncertain year ahead, our chapter has come to an end."

A month after Paul Graham, Jessica Livingston, Trevor Blackwell, and Robert Morris started the Y Combinator seed accelerator in 2005, they picked "make something people want" as their motto.

Our study shows that failing to do this is one of the easiest ways to guarantee startup failure.

1. Ran out of cash/failed to raise new capital

Money and time are finite and need to be allocated judiciously. For the startups on our list, running out of cash — tied with the inability to secure financing/investor interest — was the top reason startups cited for their failure.

In September 2019, augmented reality startup Daqri shut down after burning through more than $250M in funding and failing to raise a new round from investors:

"Daqri faced substantial challenges from competing headset makers, including Magic Leap and Microsoft, which were backed by more expansive war chests and institutional partnerships. While the headset company struggled to compete for enterprise customers, Daqri benefited from investor excitement surrounding the broader space. That is, until the investment climate for AR startups cooled."

Despite fostering partnerships with Boeing, General Electric, and NetJets, aeronautical engineering startup Aerion Corporation was unable to convince investors of its potential:

"The AS2 supersonic business jet program meets all market, technical, regulatory and sustainability requirements, and the market for a new supersonic segment of general aviation has been validated with $11.2 billion in sales backlog for the AS2.

However, in the current financial environment, it has proven hugely challenging to close on the scheduled and necessary large new capital requirements to finalize the transition of the AS2 into production.

Given these conditions, the Aerion Corporation is now taking the appropriate steps in consideration of this ongoing financial environment."

European budget airline Wow Air met a similar fate; Chairman Skuli Mogensen wrote to employees:

"We have run out of time and have unfortunately not been able to secure funding for the company… I will never be able to forgive myself for not taking action sooner."

If you aren't already a client, sign up for a free trial to learn more about our platform.

Source: https://www.cbinsights.com/research/startup-failure-reasons-top/

0 Response to "Allen M 2014 Nov 10 Data Security Governance Continue to Be Business Fails"

Post a Comment