How Do I Convince My Wife to Have a 3 Way

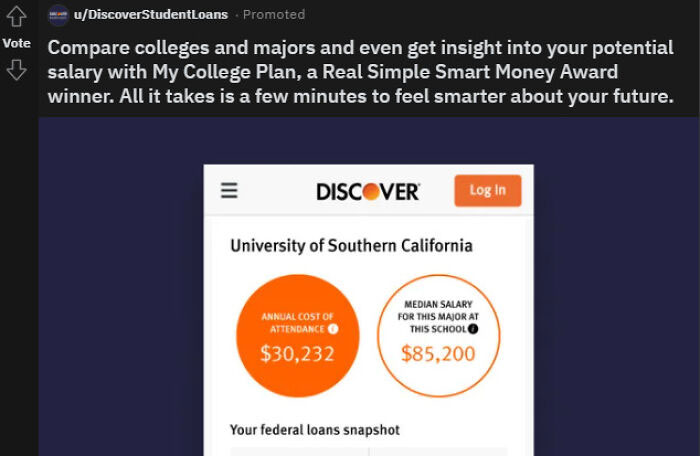

As of 2021, approximately 43 million Americans held student debt, with an average student loan balance of $37,105. In fact, Americans owe $1.71 trillion in total of student loan debt. The numbers are pretty shocking, to say the least.

Now, the sad part of owing federal student debt is the fact that a third of borrowers can't keep up with it after just six years. With so much pressure building up, all this economic uncertainty, insane housing boom prices, it seems like many millennials and younger generations are stuck in a giant hamster wheel of hell. How did we end up here?

The screenshots below will shed light on the scope of the problem and how it's basically impossible to pay off a student loan in the US. It may make your body temp soar, so if you're already feeling on edge today, you may as well skip to the next article. And the brave ones, as well as the student debt survivors themselves, please scroll down below.

The Federal Reserve estimates that in quarter two of 2021, Americans owed a startling $1.73 trillion in student loans. Despite a pause on federal student loan interest rates, the number marks a record-breaking amount and it increased 3% compared to quarter two of 2020. WalletHub has recently compared the 50 states and the District of Columbia based on 11 measures of indebtedness (such as average student debt totals) and earning opportunities (such as unemployment among recent college graduates). They managed to determine which states struggle the most with student debt.

It turned out that West Virginia is the state most impacted by student debt. The data showed that student loan borrowers from there face some of the worst ratios of student debt to income. Moreover, an astounding number of borrowers from the state are behind on their student loan payments. WalletHub data also found that New Hampshire is home to the second-worst student loan holders. The state has the highest average student debt totals and the highest proportion of students who currently have student debt. A 2020 report by The Institute for College Access and Success estimated that an average student debt total for New Hampshire residents in the college Class of 2019 is roughly $39,410, more than any other state.

The paradox of student loans is that higher education is supposed to improve our quality of life, granting access to high-quality jobs that provide greater stability, higher earnings, and critical benefits like health care and paid leave. This all turns out a distant dream after the student loan leaves many people wondering if it was even worth it. It's no secret that student debt has a profound impact on borrowers' lives and well-being. While many are not able to afford their monthly payments, those who make them usually have to make big sacrifices. For example, delaying home ownership, not starting a family and staying in unsatisfactory jobs.

The burden of debt also takes a severe mental toll on borrowers. A 2021 mental health survey indicated 1 in 14 borrowers experienced suicidal ideation in response to the financial stress of student loans. Among borrowers who were unemployed or making less than $50,000 per year, this rate jumped to 1 in 8. As of today, the Biden administration has canceled $9.5 billion in student loans for permanently disabled borrowers and those defrauded by for-profit institutions. Experts agree that this is a major step in the right direction; unfortunately, it's very far from being enough.

koulnis Report

Note: this post originally had 32 images. It's been shortened to the top 30 images based on user votes.

How Do I Convince My Wife to Have a 3 Way

Source: https://www.boredpanda.com/student-debt-loans/

0 Response to "How Do I Convince My Wife to Have a 3 Way"

Post a Comment